Spaeker 038 0084 00 29570 Rola

579-228-1501, ZANZONICO LORRINE 38 TOMPKINS PL Saint Rosalie, QC. 579-228-7481, LAWANDA TRIVITT 29570 N 163RD AVE Saint Rosalie, QC. 579-228-0084, JOANNE HEAVIN HC 1 BOX 444 Saint Rosalie, QC. 579-228-7615, MATTHEW CLARK 1264 ROLLA LN Saint Rosalie, QC. Lung Disease Including Asthma and Adult Vaccination. Vaccine-Preventable Adult Diseases Resources Lung Disease including Asthma and Adult Vaccination Language: Engl. 35 state 36 not 37 00 38 information 39 img 40 8 41 10 42 service 43 tm 44 9. 4140 speaker 4141 515 4142 362 4143 361 4144 pond 4145 412 4146 disk. 11059 xxxxxxxxxxxxx 11060 ounce 11061 gcc 11062 opp 11063 rolla 11064. Fein 20303 gnd 20304 -1890 20306 nh3 20307 wci.

NINETIETH ANNUAL REPORTOF THEComptroller of the Currency1952WASHINGTON: 1953Digitized for FRASER Federal Reserve Bank of St. LouisTREASURY DEPARTMENTDocument No. 3185Comptroller of the CurrencyFor sale by the Superintendent of Documents, U. Government Printing OfficeWashington 26, D. Price $1.50 (cloth)Digitized for FRASER Federal Reserve Bank of St.

LouisLETTER OF TRANSMITTALTREASURY DEPARTMENT,OFFICE OF THE COMPTROLLER OF THE CURRENCY,Washington, D. C., June 80, 1953.SIRS: In accordance with the provisions of section 333 of the UnitedStates Revised Statutes, I have the honor to submit the followingreport covering the activities of the Bureau of the Comptroller of theCurrency for the year 1952.Respectfully,RAY M. GIDNEY,Comptroller of the Currency.THE PRESIDENT OF THE SENATE.THE SPEAKER OF THE HOUSE OF REPRESENTATIVES.Digitized for FRASER Federal Reserve Bank of St. LouisANNUAL REPORTOF THECOMPTROLLER OF THE CURRENCYDuring 1952, the general trends in the national banking systemwere closely similar to those of 1951. Deposits again increasedalmost $5 billion and were reflected in the assets by increases of $3.7billion in loans and $1.2 billion in various classes of investment securi-ties. The emphasis on accommodating the continued strong loandemands of industry, commerce, consumers, and home buyers isapparent in these figures.

Speaker 038 0084 00 29570 Rola Full

The major borrowing sources of the $36.6billion of loans held by national banks at the end of 1952 were (1)commerce and industry, $16.9 billion, an increase of $1.2 billion,(2) real estate owners secured by mortgages, $8.3 billion, up $724million, and (3) individuals, largely consumer installment paper,$7.1 billion, reflecting a large increase of $1.3 billion.The 4,916 national banks had total assets of $108.1 billion at theyear end, an all time high level, and equal to 50 percent of all bankingresources held by the 14,596 commercial and savings banks operatingin the United States. Deposits of $99.2 billion were provided withinstant liquidity to the extent of $26.4 billion in nonearning assetscash or its equivalentand, together with $7.6 billion of capital struc-ture and reserves, were invested in earning assets in the form of loansamounting to $36.6 billion, average interest rate 4.53 percent (1951average rate 4.36 percent), and $44.1 billion of investment securities,average interest rate 1.84 percent (1951 average rate 1.70 percent).Investments in obligations of the United States increased $780million to $35.9 billion. Exclusive of nonmarketable and depositarybonds, Federal obligations maturing within 5 years were reduced $1.8billion during the year, and such obligations maturing in excess of5 years increased $2.5 billion.Consumer installment loans expanded rapidly in national banksduring the year. Regulation W of the Board of Governors of theFederal Reserve System was suspended on May 7, 1952, and there isevidence that cash down-payment and repayment terms were at leasttemporarily liberalized by some banks to a point beyond prudentlimits. There is also evidence, however, that more than a few ofsuch banks have since adopted more realistic and conservative install-ment loan policies. The lowering of credit standards to build uploan volume and earnings is recognized by all sound bankers aspoor policy and experience has shown such tendencies to be invariablycostly because of abnormal losses which follow.The investment accounts of national banks constitute a majorelement of strength in the asset structure of the national bankingsystem both from the standpoint of credit quality and liquidity.This is best illustrated by the following data:1Digitized for FRASER Federal Reserve Bank of St.

LouisREPORT OF THE COMPTROLLER OF THE CURRENCYRecapitulation by maturitiesUnited States bonds as of Dec. 31,1952; municipal and other bonds as of various examination dates duringthe last half of 1952Figures in millions of dollarsUnitedStatesbondsGeneralobligationmunicipalbondsSpecialrevenuemunicipalauthorityand corpo-rate bondsTotalShort term (maturing up to 5 years).Medium term (maturing between 5 and 10 years)Long term (maturing after 10 years)Total126,4596,2233,2392,7241,391031,0498,0895,01135,921 5,281 2,947 44,149 Includes nonmarketable bonds of $1,352,000,000.The liquidity and relative price stability afforded by this short termmaturity distribution is important and satisfying. Slightly in excessof 70 percent of the aggregate investment holdings mature within 5years.

It is apparent that depreciation accruing in the investmentaccounts of national banks as an outgrowth of increased interest rates,most heavily centered in medium and long-term issues, may be classi-fied as 'paper' depreciation. This depreciation need not culminatein actual losses because the necessity for sale prior to payment at parupon maturity is almost nonexistent in holdings so heavily concen-trated in short maturity issues. The credit strength of general obli-gation municipal bonds, corporate issues, and special revenue munic-ipal authority obligations held by national banks is at a high level.The vast majority exceed the marginal investment grade rating ofBBB (or B 1 plus or Baa).With very few exceptions, the managements of national banks areto be complimented for having adopted and followed sound invest-ment policies.

The investment accounts, as a result, are well adaptedto meet sound banking requirements, i.

I've been playing through a pair of these for the past decade with a Sovtek MIG-60 and they sounded great. I just replaced them with a pair of neodymium speakers for weight reasons. It turned out that one of them was torn (who knew? It was a used cab and it sounded fine!) and I tossed it out.

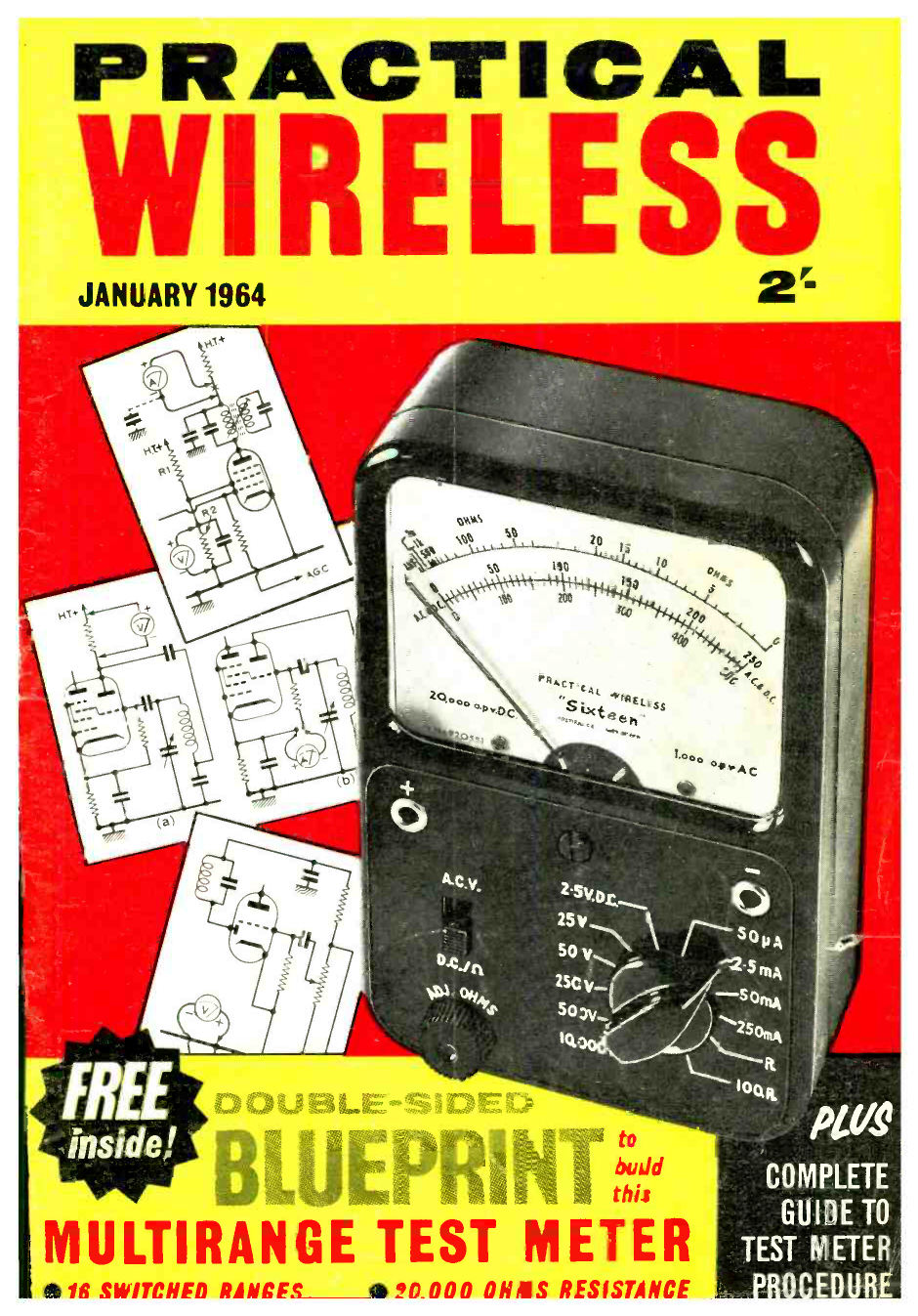

I'm selling the remaining one. I'm sure it's good for at LEAST another decade! I believe it's an 4 ohm speaker (my multimeter read 3.5 ohms). The speaker's ID # is 038-000.This item is sold As-DescribedThis item is sold As-Described and cannot be returned unless it arrives in a condition different from how it was described or photographed. Items must be returned in original, as-shipped condition with all original packaging.Product Specs Condition: Brand Model Categories Year Made In United States.